SMM News on July 31, 2025:

The preliminary operating rate of China's primary aluminum alloy industry in July was 51.5%. After excluding the impact of inconsistent operating days compared to June, it increased by 0.6% MoM, demonstrating a "stronger-than-usual off-season" performance for the month. The primary aluminum alloy PMI in July reached 54.4%, rebounding significantly by 17.9 percentage points MoM from June, surging above the 50 mark and indicating an unexpected rebound in the off-season industry. Breaking down the sub-indices, the production index was 60.0%, and the new orders index was 51.7%, both showing improvements compared to June, suggesting a slight recovery in domestic demand during the off-season. However, the increase in production was mainly due to production cuts in aluminum billets triggering the conversion of liquid aluminum, which provided structural support for the operating rate of primary aluminum alloy. The product inventory index was 58.3%, and the purchasing volume index was 61.6%, remaining relatively stable, indicating that enterprises' inventory management was becoming more rational, and purchasing activities of enterprises buying aluminum ingots for production also maintained a certain level. Nevertheless, due to limited demand recovery during the off-season, enterprises still faced inventory pressure, necessitating attention to subsequent inventory digestion. The new export orders index was 58.3%, rebounding above the 50 mark, with downstream export data also showing steady improvement over the past three months. However, overall external demand is still expected to weaken, with uncertainties surrounding Sino-US tariffs continuing to affect export expectations, necessitating attention to subsequent trade policy developments.

Looking ahead, under the triple pressures of weak demand during the traditional off-season, unresolved Sino-US tariffs, and negative feedback from high aluminum prices, the industry's weak and stable pattern is difficult to break. Despite the rebound in July's PMI due to production cuts in aluminum billets, the policy of converting liquid aluminum into alloys, and a slight recovery in domestic demand, the rebound was limited, and the industry will still face seasonal factors such as high-temperature holidays in the future. SMM predicts that the primary aluminum alloy PMI in August may still fall below the 50 mark, and it will be quite challenging for the operating rate to achieve a "second consecutive increase" during the off-season.

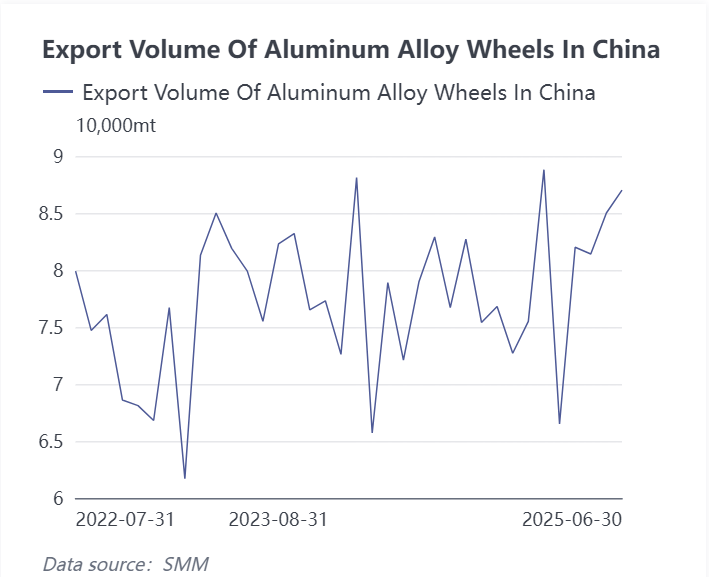

In terms of export data, customs data shows that the total domestic aluminum wheel exports in June reached 870,000 mt, up 2.4% MoM and 13.4% YoY, demonstrating strong resilience and overall steady performance. Since the US initiated a tariff war in early April, the aluminum wheel industry, which has relied on direct exports to the US accounting for over 30% in recent years, was expected to be "hit first," and market expectations for the industry's exports were relatively pessimistic. However, the aluminum wheel export data for three consecutive months from April to June remained "calm," and even after the release of May-June data, it appeared "peaceful," exceeding the expectations of most in the market.

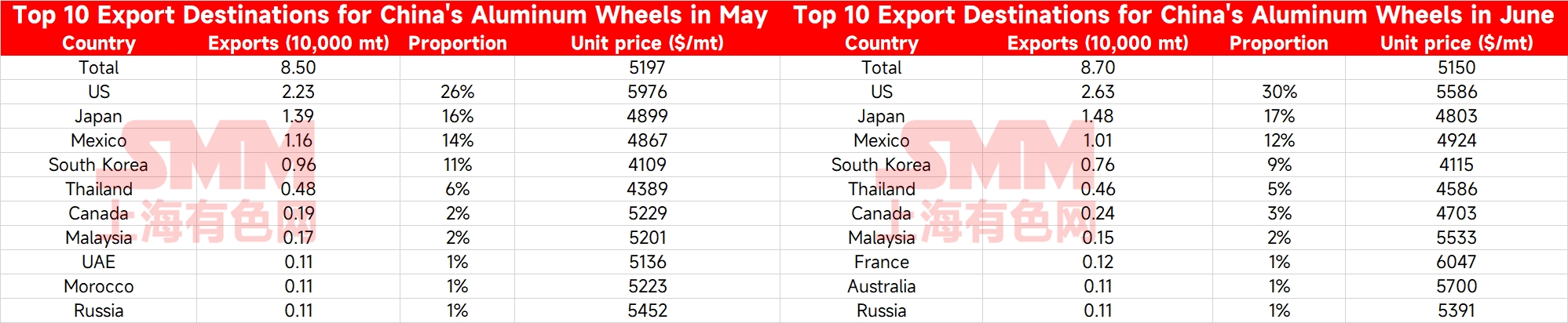

SMM aluminum market research indicates the following changes in the distribution of China's aluminum wheel export destinations in June, which warrant market attention:

1. US Market Changes: Affected by tariff policies, the volume of aluminum wheels directly exported to the US in June was 26,300 mt, still up by 4,000 mt MoM, with the share rebounding to 30%, but the unit price dropped to $5,586/mt. This indicates that despite facing tariff pressures, Chinese aluminum wheels remain competitive in the US market, though profit margins have been compressed.

2. Significant Growth in the Mexican Market: The volume of aluminum wheels exported to Mexico in June was 10,100 mt, down by 1,500 mt MoM, but with a large YoY increase. The share remained at 12%, with a unit price of $4,924/mt. As an important entrepôt trade country for Chinese aluminum wheels, Mexico maintains a stable market position, but attention should be paid to subsequent fluctuations in export volumes.

3. Other Market Conditions:

Japan: Exports remained stable at 14,800 mt, accounting for 17%, with a slight drop in the unit price to $4,803/mt, and an overall mediocre performance.

Morocco: It has ranked in the top ten for two consecutive months, with exports of 1,100 mt. Although the share is small, it has significant growth potential, possibly related to domestic enterprises setting up factories in Morocco.

Canada, Thailand: Both export volumes and shares remained stable, with fluctuations in unit prices.

From SMM's analytical perspective, China's aluminum wheel exports in June demonstrated strong resilience, especially in the face of tariff challenges. The industry reduced its reliance on direct exports to the US by making structural adjustments, such as increasing exports to markets like Mexico, Thailand, and Morocco. However, it is still necessary to continuously monitor the progress of overseas capacity ramp-up and the ability to transmit premiums in end-use markets to address potential market risks.

Looking ahead, despite the rebound in the operating performance of primary aluminum alloy in July, under the triple pressures of weak demand during the traditional off-season, unresolved US-China tariff disputes, and negative feedback from high aluminum prices, the overall weak and stable pattern of the primary aluminum alloy and aluminum alloy wheel hub industries in the second half of 2025 (H2) is difficult to break. The performance of aluminum wheel exports may enter a period of deep adjustment, and substantive recovery will require clarity in trade policies and effective alleviation of cost pressure.